With the slowdown in the macroeconomy and weak consumer demand, the Chinese dairy industry is experiencing a phase of deceleration and surplus. At the same time, influenced by factors such as consumption stratification and changes in population structure, the industry is entering a new phase of development, emphasizing both quantity and structural improvement. Consumers' demand for premium and healthy products is becoming increasingly significant, driving innovation and upgrades in niche categories within the industry. On the other hand, traditional supermarket channels are reaching their traffic limits, and dairy product sales channels are becoming increasingly diverse. Looking ahead, the industry faces both challenges and opportunities. How can enterprises break through in this new era and find new growth value points?

The main market for dairy products is shifting to lower-tier cities. Tier-3 and below cities account for 53.6% of dairy shoppers, particularly so for shelf-stable milk, cheese, and infant formula. Well received as refrigerated milk is in tier-1 and tier-2 cities, there is still room to increase the penetration rate.

High-tier cities are approaching channel saturation. Online channels, like PDD, Douyin, and take-outs, accelerate dairy products consumption in lower-tier cities. The number of consumers in tier-3 to 6 cities has surpassed that in tier-1 to 2 cities in 84% categories. Lower-tier cities boast of a large population, and entry-level consumers and young people in small town are exhibiting a stronger spending tendency.

How should dairy brands leverage the massive growth potential in lower-tier Cities?

I believe you all know Lactalis. When we are thinking about the present, it has figured out the future. From a small cheese workshop in the west of France that produced a dozen Camembert cheeses in 1933, the company has grown to become the world's largest dairy group. The futuristic thinking behind Lactalis' €28.3 billion revenue allows it to take advantage of new opportunities in the market as they arise. The Chinese market is also included this year.

Only 10% milk in the world comes from grass fed cow in the open prairie, and this 10% market is growing at 22.4% CAGR. Growing at over 30%, grass fed milk is the fastest growing track in the U.S. Maple Hill Creamery is the largest dairy company that offers 100% grass fed milk, selling its products in over 8,000 stores, including Wholefoods, Walmart, and Kroger. Growth rate was above 40% between 2017 and 2022. High-speed growth is a reality on the other side of the world, perhaps it is time for grass fed milk to speed up in China when Chinese consumers are spending more on dairy products and shifting from eating to stop hunger to eating high quality.

In recent years, the dairy industry seems to have entered an "innovative spring," with "new products every week" gradually becoming the new norm. If "new products every week" reflects the market's dynamism, then the success of these products must have something to do with their innovative elements.

On this topic, we've invited three "successful selling" brands: "Haihe", praised as the Shining Example of Domestic Products and Divine Milk by online netizens; "New Raspberry", the first to enter the stirred yogurt race and become a growth dark horse; and "Da Vinci", a treasure brand whose annual sales have skyrocketed from 30 million to an impressive 260 million yuan in just three years. Together, we'll explore the strategies behind selling and buying products.

As the leading brand in the domestic cheese stick category with a market share exceeding 40%, Milkground has achieved remarkable success in the cheese stick market with accumulated sales exceeding 3 billion units. However, the potential for cheese consumption clearly extends beyond cheese sticks. Breaking through demographic barriers and expanding into new scenarios present both opportunities and challenges. Milkground has already taken the first step towards practical implementation.

The Milk Fat Globule Membrane (MFGM) is a natural component extracted from milk, with its unique biological activity and nutritional properties, making it essential in infant formula milk powder. According to AFI research, MFGM not only positively affects infant brain development and cognitive function but also benefits adults and elderly in areas such as immunity, gut health, and muscle health. This discovery is opening up new market spaces for MFGM.

Data from Fact.MR shows that the global MFGM market reached approximately $89.4 million in 2021 and is projected to grow to $234 million by 2032 at a compound annual growth rate (CAGR) of 9.3%. Let's explore market gaps across generations starting from the Milk Fat Globule Membrane in milk and seize opportunities for growth.

Statistics show that the market size of the gray-hair sector in China is expected to reach RMB 12 trillion by 2026. Possessing both money and time, the gray-hair consumers are raising the bar of living standard. Formulated milk powder, thanks to its inherent health attributes, delivered impressive results. In the first half of this year, formula milk powder for the middle aged and elderly grew by 57% year-on-year. As the infant formula market enters a phase of stock competition, milk powder for middle-aged and elderly individuals, with claims of benefits for bone health, sleep quality, and blood sugar control, has become a new growth segment. Mapping out the development in the middle aged and elderly formula milk powder market is the key to growing in an expanding market.

According to BCG, the global market for new proteins is expected to reach US$290 billion (about RMB 2.08 trillion) in 2035, accounting for 11% of the market share of all protein types. In recent years, microorganisms have also gradually come into the vision of China's agri-food companies, becoming the third largest source of protein in addition to traditional crops and livestock resources. What are the products and applications of global and local innovative companies based on different microbial species and technology pathways? What are the consumer perceptions? The results of the Consumer Communication Study on Fermented Protein Products will be presented exclusively on-site!

The dairy industry is being challenged by sustainability, cyclicality of raw material supply and relative monopolization of resources. The development of precision fermentation is bound to bring about a sea change in the dairy industry.

"Our product isn't just like cheese, it is cheese," exquisite fermentation technology is revolutionizing the cheese industry. In terms of consumer acceptance, research from Formo, a precision fermented cheese brand from Germany, shows that 71% of consumers are willing to purchase non-animal dairy products crafted with precision fermentation techniques. In terms of taste, Formo's products have also gained favor from Michelin-starred chefs! Moreover, from a business perspective, Formo has secured the largest Series A financing round to date for a food technology startup in Europe. This is truly awesome!

It's no exaggeration to say that Perfect Day has taken the lead in the burgeoning field of precision fermentation for new protein. Commercialization is particularly crucial in emerging markets. As the new protein industry gradually matures, what does the industrial ecosystem look like? What about the market environment? We're eager to hear the story of Perfect Day, the pioneer of "man-made milk," a star company that has raised $840 million, and simultaneously the company with the most commercialization cases in the precision fermentation field (being favored by international giants such as Unilever, Nestlé, the Bel Group, and Mars). Let them tell us the story of Perfect Day and its friends.

Over 50% offerings at cafés in China are milk coffee, making for a fertile soil for fresh milk growth. When milk moves from the backstage to the front under the hat of barista milk, performance becomes a core measurement. Founded less than 10 years ago, Milklab, the Noumi's subsidiary brand, has filtrated 73% cafés in Australia, thanks to its excellence in textures, stretches, and making latte art. This is just the beginning. Gradually taking off in China, Southeast Asia, Singapore, and Malaysia, Milklab is walking into a broad international market.

Welcome to on-site coffee tasting! We are afraid that at this session only milk coffee is offered. Have a cup of coffee and experience the long-lasting aftertaste brought by the more integrated milk, then in this aroma, chat with our speakers about the culture behind this cup of coffee.

Euromonitor data shows that China has been the world's second bakery market besides the US since 2016. When young consumers become the main consumer group, the taste, shape, and color of products have different requirements. Cream, butter, cheese...... How to meet the ever-changing bakery and dessert market with a wide variety of dairy products? Sinodis under Savencia has prepared "Inspiration Recipes", which will be presented at the event. They'll be there to share inspirational ideas with you!

The snack market is ever-changing, with fierce competition among various players. What transformations have occurred in the snack market this year? Where are the next growth points and opportunities? Let's first discuss the new trends and emerging waves!

In the face of performance growth, channel is undoubtedly a strong correlation variable. In the snack market, each transformation in distribution channels often leads to the rise of new brands, driving changes in the snack industry. Previously, there were Three Squirrels and Be & Cheery, who successfully mastered the "traffic code," and now there's MMHM Group, seizing the bulk purchase opportunities...

Haoxiangni invested in bulk selling in brick-and-mortar stores, Jiashili comprehensively build omni-channel and continuously expands sales networks. In the surging snack market, how can brands make high growth sustainable? Fully embrace the changes in channels should be the key!

Since entering the Chinese market, Ferrero Rocher has created numerous "golden wonders" through unique market insights and product innovations, becoming an essential item for Chinese New Year celebrations. However, Ferrero Group is not content with just this. Ferrero continually expands its product boundaries and engages closely with younger consumer groups. By extending gifting scenarios, meeting emotional needs, launching dark chocolate products, and targeting niche markets, let's explore the innovations Ferrero brings beyond its classic "golden" offerings.

In Japan, where gift-giving and dessert culture are very strong, chocolate has long been the "national snack" of Japan by virtue of its social attributes and sweet flavour, beating all other sub-categories by nearly 17%. The bigger the market, the bigger the competition, how in the world should brands break through? How can Godiva define itself as a high-end chocolate brand and make itself a "luxury brand" in the extremely voluminous market? How can Godiva quadruple its revenue in 13 years? How does Godiva make consumers fall into the chocolate "vortex"? You must comeon site to hear the answers!

(Source: LinkedIn@Godiva Chocolatier)

Who says candy doesn't sell well? By understanding consumers and being innovative, you can still win the hearts of all age groups with sweetness! Hear directly from the CEO of Kanro, the leading brand in Japan's candy market!

In 1955, Kanro opened the door to "innovation" with Japan's first soy sauce candy and the first twisted cellophane packaging. 69 years later, in an era when sugar is often viewed with concern, the 112-old Kanro achieved 1.35 billion RMB in revenue in 2023. With a 15.7% market share in gummies and an impressive 20.8% market share in hard candies, Kanro firmly holds its position as Japan's number one in the confectionery market (excluding chocolate)

*DATA: Intage SRI+ estimated market scale Jan. 2023 to Dec. 2023

(Source: Kanro website)

The konjac is going viral! The konjac products of YanJin Food sales up 163% YoY in H1 2023. The first slice of konjac vegetarian tripe on the market with the ultimate taste and innovative flavors to make consumers from excited and "addictive". Let's see how YanJin Food can use konjac to pry the hundred-billion-level snack market.

Consumers of health, taste and texture of the ultimate pursuit of konjac, so that the dormant 3000 years of konjac has finally been "tapped" out more potential. This colourless and tasteless agricultural products, has become the brightest presence in the snack market. In addition to jelly and vegetarian tripe, what kind of konjac product can still be created? Let's start from the R&D and innovation, to explore the konjac in the future of the infinite possibilities!

When it comes to plums, the LiuLiu Orchard Group must already appeared in everyone's mind. With a small plum, Slippery LiuLiu Orchard Group has opened up a big market: with 2 billion pills sold a year, green plums have taken over the minds of consumers.

However, the market needs innovation, so the LiuLiu Orchard Group has successively launched plums without kernel, plum jelly, plum cake, with plum as the core of the product matrix is becoming richer and richer. In today's snack market, how many more possibilities are there for the 3,000-year-old green plum?

Still think grains as a breakfast food? It has broken down the shackles of breakfast and penetrated more dining scenarios as indicated by 11.4% CAGR from 2017 to 2022.

Keto friendly, gluten-free, nuts-free, granola … Grains meet all of your needs all day long. Boasting of a thousand-trillion-scale market globally, grains—from cereal, energy bars, to outdoor snacks—have infinite potential in the domestic market.

Consumer loyalty is shrinking. New products keep emerging and brands are caught in chaotic fights, trying hard to be remembered. In the fight for survival, no two species can occupy the same ecological niche, while in the business realm, brands have to pare down and focus on the core category to win consumers’ mind.

Let’s then have a chat about the "pruners" and "magnifiers" for brands’ deployment strategies.

How can snack brands break through product homogenization and stand out to consumers who want it all?

Following the "Three Reductions" standard of reducing oil, sugar, and salt, Bestore has upgraded to the "Five Reductions" concept (reducing salt, sugar, fat, oil, and food additives) and launched a series of new products with a health-oriented "label": reduced salt and preservatives, zero trans fats, "Clean Label" 2.0, and more. These products achieved impressive results, surpassing 4 million in sales across all channels within one week.

What is the business logic behind Bestore's new proposition for 2024? How do their products and IP integrate into the lifestyles of young consumers? What other surprises does the brand have in store? Only at FBIF 2024 will you find out!

Facing the ever-changing snack market and the new generation with an attitude, how can classic brands approach young consumers in a more vibrant, relaxed and approachable way? PepsiCo must be highlighted on this topic! How can PepsiCo, as an "old" brand, maintain the contrast of a young brand image? It has completed iterations and upgrades time and again, used innovative thinking to lead the wave of the new generation, and has continued to promote the growth of brand power and commercial value in both directions. In this speech, Nina Mu, Chief Marketing Officer, Greater China Foods, PepsiCo, will focus on how to create a sense of youthfulness for the brand, expanding new scenarios, localised innovation and digital drive, which are the core secrets of PepsiCo always being "so young"!

What?! Young people are running away from home? Statistics show that the demand for snacks in outdoor activities, as one snacking scenarios, grew dramatically by 48.3%. Outdoor activities, like travelling, camping, and markets, are extremely appealing to young people and provide an excellent opportunity for snacks penetrating new scenarios. This time, brands shall go wherever consumers go.

Reminder: no time for camping due to this event? No worries! We will set up tents indoor and experience with you the ceiling-free romance. Make you seize every fleeting inspiration!

Data shows that over 87% of consumers are choosing products based on ingredient lists, yet the lengthy ingredient lists in baking products often make them "difficult to understand and hesitant to eat." How can the challenge of ensuring that clean label foods are also delicious be overcome?

Biological solutions from nature can reduce the addition of emulsifiers during the baking process while maintaining excellent taste. In short: clean and delicious! Let's explore with Novonesis how biological enzymes can "activate" the clean label baking market, making it clear for consumers and ensuring they can eat with peace of mind.

The speed of bakery pop-ups has changed from "yearly" to "monthly" or even shorter, and bakery products have become the "secret of flow" to catch the Gen-Z. The main consumer "bread and dessert lover" is "pressing" the bakery industry to integrate with retail, supermarket, coffee and tea, catering, e-commerce and other channels. It has even successfully broken the circle and become the magic weapon of luxur to catch young people.

However, the complex technology, high cost and consumers' pursuit of freshness, flavor and high quality in the baking industry have often kept people away, so what else can be done? The Puratos Group, a century-old Belgian food technology company, will unveil the mystery of the baking industry, and use the new frozen technology to enhance the baking fusion, and directly tell you how to make the "cake" of frozen baking bigger and bigger!

In China's baking market, offline presence still reigns supreme. However, since 2020, there has been a notable increase in brands "transitioning" to online channels. Faced with the blue ocean of online channels, how do baking brands seize opportunities and successfully transform?

Garden Bakery managed to increase its online revenue share from 0% to 30% within 3 years, expanding its business nationwide with its signature products. Starting from mooncakes in 2006, Garden Bakery has now made its cheese buns widely known. How did Garden Bakery achieve this success? Let's step into the secret "garden" of this baking brand and find out.

Products are just the results. The first step of innovation starts with insights into new consumer segments, new scenarios, and new channels.

With the rise in commodity costs and the influx of e-commerce into the production end, a large number of OEM factories are stepping into the spotlight, facilitating the process of brand consumerization through channel borrowing. However, research and development are not simply about replacing big brands, and marketing is by no means equivalent to platform promotion. Supply chain brands lacking in R&D innovation and brand marketing capabilities will struggle to survive in the long term relying solely on "production" as their lifeline.

Keyang - the leader in cereal drinks. The growth rate in 2023 will exceed 150%, and it has been certified by Sullivan as the pioneer of the red bean and barley water category and the market leader in category sales! Zhonghe Food, a subsidiary of Keyang, has nearly 30 years of experience in red bean processing, and its annual filling production capacity is as high as 10W+ tons! From red bean processing to red bean barley water, how can Yang C-end successfully transform?

YUZU VALLEY set a good example from the beginning by creating the new category of double yuzu juice. However, the subsequent influx of low-priced imitations intensified competition. In response, YUZU VALLEY upgraded to the new "YUZU Juice" brand last July, moving from a category-driven approach to a dual strategy of category + brand. This innovation helped break the cycle of low-price competition, and within two years, sales exceeded 1.1 billion yuan.

Restaurant chains grew from 12% in 2018 to 19% in 2022, according to Meituan. The highest growth in chain expansion, 45% year on year, is seen in the 5,000-10,000-store band.

Starting from traditional catering channels, Hope Water achieved sales exceeding 500 million yuan within 4 years and is expanding into more dining scenes. XianMu Technology occupies 20% of the catering supply chain market, focusing on emerging leisure dining scenes and building a bridge between leisure dining enterprises and beverage brands.

Facing the continuous differentiation and upgrading of catering channels, Hope Water and XianMu Technology will interpret new opportunities for beverage brands from different perspectives.

There's no doubt that ginger remains a promising contender. Ginger flavor enjoys considerable acceptance worldwide. As early as 2017, Google's beverage trend report noted a 32% increase in searches for ginger drinks (including ginger tea, ginger beer, and ginger ale) across the United States, United Kingdom, Spain, and Mexico. Searches for categories like ginger water and ginger juice grew by 79%. According to Technavio's data, the ginger market is projected to reach $3.4 billion by 2026, with a compound annual growth rate of 7.3% from 2021 to 2026. While ginger beverages have seen rapid growth in the Asia-Pacific market, they have yet to establish dominance as a flavor profile in the Chinese market.

For 64 years, Bundaberg, originating from Australia, has been committed to handcrafting "craft" sodas. Not only is it well-known in Australia, but it has also expanded its business to 60 countries worldwide, generating a revenue of 1.5 billion.

Entering China 8 years ago, Bundaberg started with its classic ginger beer, using its unique ginger flavor to tantalize consumers' taste buds. It then introduced a variety of colorful fruit-flavored sodas, gradually establishing an iconic brand image. Now, how can Bundaberg in China leverage rapidly developing emerging channels to enter more everyday consumption scenarios and unlock broader markets?

In order to explore the possibility of ginger flavor in the Chinese market, FBIF specially invited 5 top domestic and foreign ingredient companies as beverage flavor designers to select and send 2-3 groups of ginger-themed flavor innovation works, and conduct on-site scoring through evaluation in various dimensions. Enlighten the perfect use of ginger flavor in beverages and the innovative development of ingredient design. In this interaction, creators can not only freely play around the theme, but also choose their favorite brands to create targeted creations, thereby gaining explosive exposure and cooperation opportunities. Don’t miss it!

Everyone loves the taste of lemon! From classic drinks like Sprite and iced tea to upgraded options like cold-pressed lemon juice and hand-crafted lemon tea, lemon, with its balance of tartness and sweetness, brings endless possibilities for beverage innovation. The Lemon Republic, founded three years ago, has achieved sales of over 300 million yuan with an overall repurchase rate of 25%. The freshly made lemon tea brand, Lemon Right, offers consumers the experience of tasting "three types of lemon in one sip" and has surpassed 150 stores within two years of its establishment. Mengtai Biotechnology is rooted in the industry, pushing Tongnan lemons into broader markets...

How did lemon become a classic flavor in the beverage industry? Currently, what other opportunities are there for innovation based on lemon?

The growth of unsweetened tea has been evident to all, but the competition in this popular category is particularly fierce. In this highly competitive track, inikin Fresh Tea from Yili Group, as a uniquely distinctive new product, has achieved a top 30% ranking in average daily single-store sales within part of the convenience store system, compared to overall beverage sales.

In today's market, where value for money is paramount, the juice industry, with its relatively low barriers to entry, must be especially wary of homogenization and the risk of bad money driving out good. Facing a complex competitive landscape, Huiyuan Juice, a company with 30 years of experience, has chosen a dual strategy of "focus and innovation." Between 2022 and 2023, after reducing its SKUs by 80%, Huiyuan Juice achieved a 167% increase in profits. Innovative products like prune juice and cilantro juice have also opened new opportunities for the company. A more focused strategy and more grounded innovation may be the key for Chinese juice companies to grow bigger and stronger in the future.

From "Tastes Great" to "Remind Every Day", from the iconic coffee bean ICON to the agile little red bird, Nescafé, which holds the largest share of China's retail coffee market, "recreated" itself this year with a new Nescafé: From brand mindset to innovative products, what insights are behind Nescafé's new moves? And what trends will it lead in the Chinese retail coffee market?

When personalized and aesthetic upgrades became the "standard rhetoric" for new consumer brands, it focused more on cost-effectiveness. When cost-effectiveness became the "consumer's first choice", it wanted to become a more story-driven, unique brand—Tasogare Coffee seems to always take a different approach. Since starting with online sales of drip coffee, Tasogare Coffee, founded 9 years ago, has sold over 1.3 billion cups of coffee as of December 31, 2023, and has amassed over 10 million fans across all channels. In an increasingly competitive coffee industry, how can Tasogare Coffee, which does not aim for first place, find its niche and continuously create more value for consumers, the company itself, and society?

On the vast land of China, a rich and diverse food culture has flourished. Countless locally distinctive beverages have accompanied generations as they grew up: apricot kernel tea, butter tea, Asia Sarsae, Haibao tea (kombucha)... Some originated locally and became hits overseas; others came from abroad and eventually took root in China. Regardless of where they come from or where they go, they are all closely tied to our culinary culture and forever carry the mark of life here.

The "Wow Drinks" hidden in the map.

Based on social media insights and TMIC data, regional flavors are becoming one of the key labels for beverage innovation. Why can regional flavors become the next growth point for beverages? How can beverage brands seize the growth opportunities brought by regional flavors?

Asia Sarsae has an annual sales volume exceeding 200 million bottles, originating from Fujian and eventually listed in Singapore by Yeo Hiap Seng. Guhe sour plum soup can sell tens of thousands of cups a day... More and more local specialty beverages are gradually being accepted by the public. In the current era of "small is beautiful" that is approaching, how can local flavored beverages, which no longer blindly pursue "flagship products", become more and more "beautiful"?

Regional flavor beverages have endless potential, but they still face various challenges in the actual sales process: How can specialty products integrate into the dietary culture of other regions? How can product packaging retain its uniqueness while appealing to a broader audience?...

We have invited guests from Ries Category Creation Strategy & Consulting, Intuivia & TMICto lead us in analyzing specific problems and finding new growth strategies.

UMAMI COLA adopts an upside-down cola can packaging, offering consumers a unique opening experience. However, UMAMI COLA's uniqueness doesn't stop there: founder Mr. Takahisa Yamada drew inspiration from the long history of sake brewing techniques in Japan, "brewing" UMAMI COLA using herbal plants. It substitutes sugar with Sweet Koji Rice from the Hakkaisan, and its ingredients include elderflower, tulsi, citrus depressa hayata, as well as components commonly found in energy drinks such as arginine, niacin, BCAAs, GABA, and vitamin B, etc.

Let's explore together on-site: how does the upside-down UMAMI COLA cans overturn the traditional cola market?

(Source: UMAMI COLA website)

Sipping Across Borders: Strolling Through the Global Alcohol Markets

In 2023, the groundbreaking collaboration between Wuliangye and Campari gave birth to a novel cocktail named "Wugroni." This innovative concoction not only pays homage to Negroni's enduring popularity but also opens up fresh avenues for the cross-cultural exchange and mutual admiration between East and West. What unique perspectives and considerations guided Campari in embarking on this inspiring journey of collaboration?

Bar SanYou, from 2019 to 2023, was honored for five consecutive years as one of the Asia's 50 Best Bars and received accolades such as the "DRiNK Magazine's Bar of the Year in China" and "Best Cocktail Menu." The founder, Bastien, has led a team that has served numerous leading Chinese Baijiu enterprises, assisting many Chinese baijius in finding new "modes of expression."

Bastien will share with us his experiences from the past year in promoting the culture of Chinese Baijiu globally: What kind of innovation and storytelling can help traditional Chinese Baijiu win over more new consumers?

Chinese spirits, with their diverse styles, are beginning to make their mark in foreign lands. Whether in the trendy bars of London or the bustling cities of the United States, Chinese spirits are exploring new identities. This is not just a commercial journey, but an adventure in cultural integration.

In this new age of exploration, how can Chinese spirits expand into broader overseas markets? How can they resonate with and win the affection of local populations abroad? The rising market newcomer, Meijian, has already made many efforts in this regard. Let's raise our glasses and toast to the future of Chinese spirits on the global stage!

On The Road Store integrates its youth culture content with offline alcohol retail, creating a new concept of "alcohol convenience" — a street-style social retail alcohol convenience store. How does On The Road Store attract more new customers from online to offline? How does it become the first place young people think of when they want to "take an easy drink"?

From the perspective of the product itself, alcohol might be one of the least innovative categories. In fact, its unchanging nature could be considered a "virtue" of alcohol. However, different generations of consumers have vastly different understandings of alcohol, especially in today's age of information explosion and heightened individuality.

So, where exactly do the opportunities for innovation in the alcohol industry lie? Dr. Xu He from RHIZOME CONSULTANCY will guide us back to the essence of "people" to discover opportunities for innovation within the context of alcohol.

DRUNK N’JUMP, which has different characterists of different pubs, played the revenue broke 100 million by the community in the last year, making a new kind of possibility of pubs.

Yi Sui said: "The logic of marketing is somewhat like a fisherman above the water, continuously attempting to catch freely swimming fish below using spears made of insights, trends, and creative campaigns. But why not try jumping in and swimming with them?"

DRUNK N’JUMP is like this, a sea where everyone can swim together, allowing each person to maximize themselves. In this process, people, space, and content naturally blend, and DRUNK N’JUMP has also become a small tavern with an annual revenue exceeding a hundred million, giving everyone the freedom to drink and to be themselves.

So, how was the "people-centered" DRUNK N’JUMP perfected?

1. What scenarios would make contemporary young people want to initiate a drink?

2. In these scenes, what kind of products can be selected?

3. How should alcoholic beverage brands adapt to changes in consumer behavior?

Neil, founder of BLUE DASH, a new drink brand that continues to grow sales by 200% year-on-year in the first half of 2023, Gin Zhang,head of Chinese Baijiu (Sichuan & Guizhou) of TAOBAO & TMALL GROUP with years of experience in industry collaboration and consumer expansion, will share their insights and practices with us.

Let's toast to a beautiful world where every sip is a friendly invitation to embrace diversity and heritage.

Tasting Menu:

Campari Group - Fusilli of Five Grains, Classic Italian Apollo

Los Vascos Cromas - Los Vascos Cromas Chardonnay Gran Reserva & Los Vascos Cromas Syrah Gran Reserva

Bar SanYou: Baijiu Cocktails, FBIF Specials (Come & explore!)

China is a vast country with a wide range of flavors, each of which could be the next dark horse. With the increasing degree of restaurant chain, a city to enjoy all cuisines has been the norm, so condiments companies can catch the golden opportunities from the trend of the cuisine? At the same time, the impact and influence of the world's flavors, whether the collision can be transformed into unexpected new products? iResearch will debut the 2024 Condiments Market Trends White Paper at FBIF, based on its consumer research data and in-depth interviews with industry experts, to provide you with an interpretation of the latest domestic and international flavor trends and consumer preferences.

Regional culinary habits give rise to well-known regional condiments brands. But moving from regional to national is often challenging—lack of direction, lack of force, or lack of continued development. Can regional brands break the constraints and scale up by replicating a replicable model?

It takes decades of consistent export and popularization of foreign food culture and her ingredients to a new country. As a classic Asian condiment, soy sauce faces the challenge of winning over India, a country known for its diverse spices. Just 3 years after the launch of Kikkoman soy sauce in India, the company has achieved steady sales growth in more than 30 cities. The untold story is that its success is backed by an 18-year effort to export Japanese food culture. Give priority to cuisine culture first, then brands go global.

Join us to find out from Harry.

Tomato flavor is a popular choice in the non-spicy world. Whether it's Chinese or Western cuisine, tomatoes are everywhere. When product innovation has to break through the shackles, how much effort does it take to make just one tomato good in the cooking?How much thought has gone into a single “tomato” in this deep collaboration between SICHUAN NEWHOPE FLAVOR and Sam's?

The trend of salt reduction has been going on for years, and the solutions to reduce salt have been iterating. When consumers are convinced that a clean label is better, how do we meet consumer demands while ensuring good flavor? Perhaps yeast extracts can bring about a revolution in taste, allowing the tongue to feel "salty" and "umami" without consuming too much sodium.

In 1368 (Ming Dynasty), a small "MIOGEE" vinegar workshop revolutionized the vinegar making process, started to make vinegar for the royal family, and gradually grew into the Shanxi Mature Vinegar Group today. After 656 years, the vinegar is not old, but breaks through the shackles of vinegar as a flavoring supporting role, and creates the brand positioning of high-end light nutrition, making vinegar become the shining protagonist.

Tradition ≠? --The answer is MIOGEE itself!

In the eyes of consumers, one vinegar brand has moved to a much more premium position than others. Founded in 1605, Giuseppe Giusti is an Italian balsamic vinegar brand whose vinegar-making techniques and recipes have been used for over four centuries. As a supplier to the Italian royal family since 1929, the brand is known for its craftsmanship and innovation. Revenues for Giusti in 2023 is RMB 130 million, boasting a 25% increase from 2022 and an impressive 100% growth compared to 2020, and international markets contributed by 60%. Giusti trades craftsmanship and time for rarity. What exactly are the thoughts and perseverance behind a sip of vinegar? How has ordinary vinegar become extraordinary and become high-end?

When vinegar is a condiment, it may only be sold for more than ten yuan to the kitchens of thousands of households; when vinegar is a culture, its value will be infinitely enlarged, and it will be sold to more diversified applications scenarios and consumers. Vinegar, known as “black gold”, is not only the time to give high quality, creating a high value, while the plasticity of vinegar itself will also bring more innovative thinking brand. From “consumption” to “enjoyment”, how many commonalities and differences are there between Chinese and Italian high-end vinegars in brand marketing and new product development? (PS: Do you know how rare it is for the top vinegar brands of both countries to meet and exchange ideas together?)

Innovations in compound condiments seem to be drawn into a whirlpool of mutual copying. Standing in front of a shelf, one hardly sees anything else but fish with pickle cabbage, beef in sour sauce, or crayfish. Almost all Sichuan-style flavors have been turned into condiments products. China is a very big country. Are there any other flavors on the map holding high potential to win nationwide popularity?

If vinegar was not just a cooking condiment, could it be sweet, spicy, coffee-flavored, prebiotic, postbiotic, adaptogen, and Vitamin C? By adding functional ingredients and expanding the flavor boundary, overseas vinegar makers have changed the fate of vinegar, earning tens of millions of dollars in revenue.

What have they done?

A survey on Chinese consumers' trust in the safety of 3R food in 2023 reveals that only 22.18% of the respondents have very high trust. The "campus scandal" of 3R food in September brought 3R food again under scrutiny. Not fresh? Not safe? It has dawned on people that consumers' perception has not changed despite that 3R food has evolved for many years. Make yourself heard! How should we cope with the notorious reputation?

America is the home of prepared foods, and now it is very mature and has launched many innovative products. Although prepared food has been quite common in America, the Chinese prepared food industry is still not trusted by consumers. The prepared food industry in China is still in its infancy. Chinese consumers doubt its illegal additives or it does not taste as good as a fresh meal.

It's time to clarify the misunderstanding of prepared food by presenting the development of American prepared foods, showing the latest trends, and how to counter nutrition myths about prepared foods.

In 2021, Ding Ding Fresh, founded less than a year ago, achieved over RMB 200 million in sales.

By December 2022, monthly sales reached RMB 220 million for Ding Ding Fresh.

In 2023, the company's annual revenue surpassed RMB 1 billion and attained a monthly repurchase rate of up to 30%.

…

From product selection to channels, how many details must be done right to make a viral product?

One approach is to turn culinary masters' recipes into the 3R format, and the other is to seek inspirations from everyday cooking at households. Each has its pros and cons. What are the similarities and differences in R&D, supply chain, channels, and marketing? Let's take a deep dive.

From catering to new retail, DaDong Roast Duck has triumphed to the top of the Double 11 Roast Duck category. Flavor restoration, form innovation, channel pioneering, and overseas exploration ...

How did the business of roasted duck-prepared dishes from 0 to 1 become more and more prosperous?

In the age of the fast pace, consumers are sceptical of the ambient foods that they can't go without. Suppose you've ever taken a closer look at the ingredient lists of ambient food. In that case, you'd be surprised at how far they've come from illegal food additives and how unique and diverse the packaging is. However, most consumers, and even some in the industry, are still stuck in the years ago. "People harbour prejudices which are tantamount to the formidable mountain. "perhaps we need more companies with the spirit of a "Foolish Old Man" to remove some of the misunderstandings in people's minds about ambient foods. From the three key points of R&D of flavours, category differentiation and packaging diversification, how can ambient food players seize the innovation? Dispelling the misunderstanding of "temperature", how many growth opportunities are hidden under the ambient track?

The year 2022 saw the first negative growth of Chinese population, bringing China into an accelerating aging society. Japan, the country that is aging the fastest, has started exploration into food for the elderly population 20 years ago. Statistics by the Japanese Universal Design Foods Committee show that production value and annual sales of Universal Design Foods (UDF) grew 532.75% and 276.2% respectively from 2013 to 2022. Taking reference from the 100-billion-scale UDF market in Japan, what surprises are around the corner as the gray-hair economy booms in China?

Functional foods come into a furious gallop, estimated to reach RMB 321.46 billion in 2023. As the market is increasingly regulated and more players join, research and development become the powerhouse of competition. Keeping trends in sight, which ingredients are on the brink of shooting up?

With Artificial Intelligence advancing at a rapid pace, how does the human brain match up? Smart eaters are leading the new trend of dietary brain health! It has been scientifically proven that probiotics can regulate emotional stress through the gut-brain axis, plus mystery brain nutrients can also boost focus, memory and more. In addition to probiotics, what other specific ingredients can help?

According to Future Forum, more than 40% of the world's workforce is now exhausted from work. Burnout is the result of long-term excessive stress that results in extreme emotional, mental, and physical exhaustion. It not only creates negative emotions, but it also reduces our sense of value. With the increasing social pressure, "burnout" is spreading to more dimensions. In addition to giving ourselves a vacation at the right time, stress management is an essential lesson we all need to learn.

The Ready-to-Drink protein beverages market size has reached $1.56 billion by 2023, with a CAGR of 7.72%. The convenience and diversity of Ready-to-Drink protein products have attracted more and more new consumers, slowly advancing from sports supplementation to a lifestyle, and becoming a new necessity for consumers to obtain healthy nutrition.

Ready-to-Drink protein products, which are already very mature in North America, are still in their infancy in Asia, especially in China. However, new categories also mean new opportunities. As a potential stock of protein supplement products, what are the expansion directions for Ready-to-Drink protein products?

The emerging sport represented by marathons is becoming increasingly popular among the new middle class. The enthusiasm of the middle class for marathon running has surpassed the sport itself and has become a pursuit of quality of life and self-control. What is actually shed in marathon running is the anxiety about health. From fitness and shaping to improving immunity and emotional management, how can crispy middle-class individuals stand out on their health track?

Lactococcus lactis strain Plasma (LC-Plasma) actives pDCs on the cellular level, and pDCs play a key role in the immune system. The key component of pDCs activation is retained in the cellular material of LC-Plasma. Therefore, both live and heat-killed LC-Plasma work the same way. Japanese brand Kirin adds Plasma to beverages, candies, and even oats. Immune support is being built up from snacks to meals.

People will have different immune needs depending on their age stage, and this has not only become consumers' most significant health concern, but also the category with the largest sales share among probiotic supplements. Wanting to fulfill the different needs of yellow hair, the probiotic team applied for the battle!

DE111 (Bacillus subtilis), a long-established probiotic that has been around for over a century, has been officially approved for marketing by the NHC. Unlike other probiotics, DE111 is robust and can remain active even in harsh conditions, overcoming dosage form restrictions and opening up new possibilities. This well-established probiotic is set to make a big impact in the Chinese market!

Synbiotics, as the leader in gut microorganisms, is evolving into a new era of top immune ingredients. Synbiotics SYNEO® has been extensively researched in clinical trials and continues to impress with its lasting positive impact on infant gut health, and it can also benefit individuals with cow's milk allergy. Let's embrace the "Era of Synbiotics" together!

Diets like the low-Carb diet, the Ketogenic diet, people hate their restrictive nature. The Chinese carb fiends need to ensure average carb intake, which is crucial and not too harsh, to ensure that they do not regain the pounds they lose in the long run.

What is a more suitable weight loss solution for the Chinese? The answer will be revealed by - Resistant Starch (RS)!

From toddling to hobbling, the bones and joints of the elderly population have become fragile. 32% of middle-aged and older people (pre-70s population) have been diagnosed with joint problems, and the freedom and flexibility of the body have gradually become a luxury.

Facing the deep aging in China, how does 5-Loxin, a bone and joint health ingredient, help realize the dream of healthy aging for the huge elderly population to travel and play in their rich and free retirement time···

We all thought yangsheng—TCM-based health preservation—was far away from us, but the next second we see Gen Z have started to make wolfberry tea at the workplace and shaibei—exposing back to sunlight—on hot summer days prevails Xiaohongshu. On the other side of the sea, oriental herbs are also gaining popularity. Japan, for example, has seen price increase in nothing but OTC kampo (traditional Japanese herbal medicine)—up by 15% in the past 5 years and doubled sales online. In the western world, "food is medicine" takes off, packed with herbal drinks, like Rebbl and Kitto. It is evident that this generation of consumers value life. Let's look into the opportunities brought by oriental herbs from a global perspective.

There are about 20 brands for chickpea products in the U.S. Sabra, the chickpea brand of PepsiCo, has 2023 revenues of $200-500 million, according to media estimates.Global CAGR of chickpeas is expected to reach 5.8% from 2023 to 2030, to which are contributed by versatile product forms—paste, milk, snacks, and staple food, etc. Chickpea products are quietly accelerating in China, expanding from a primary agricultural product to scenario-fit leisure snacks. There is void in the chickpea market to be filled by brands through reshaping the product, just like how they have built up oats in China.

In Sept 2023, Nestlé premiered a breakthrough global sleep study in China, which found that a new formulation combination can effectively support sleep quality in adults and enhance next-day cognitive performance. Only five months later, Nestlé first launched a new milk powder based on this research in China, realizing the rapid conversion of scientific studies and products! How can global research resources be leveraged to achieve localized innovation so that there is a "zero distance" between scientific research and products?

The reduced sugar or zero sugar trend appears to be unstoppable in the beverage market, but fruit juice has been an unsolved problem until recently. Different from other categories, fruit juice inherently contains fructose, sucrose, and glucose for which regular actions like using less sugar or dilution isn’t optimal. NTFC has successfully pioneered a sugar a technology that removes 100% of the natural sugars from fruit juice concentrate while preserving the nutrition. When dilution is not the only way to reduce sugar, will this method create possibilities in other categories?

Pharma is entering the food and beverage industry too? AKG isn't alone. Known for rigorous production, AKG is set to connect with the FBIF audience.

Reports from Nature, Aging, and other journals reveal AKG's ability to extend the lifespan of aging mice and reduce the human body's physiological age by 8 years. Beyond anti-aging, AKG excels in beauty and skincare, antioxidants, exercise, and wellness. How is AKG moving from medicine to food and beverage?

Back in 1931, Winston Churchill dreamed of eating chicken without having to raise it. More than 90 years later, harvesting meat with a single cell in a lab is possible. Welcome to the world of cultivated meat. Joes Future, Meatable, and Aleph Farms tell you what each technological breakthrough means and what "the future of the meat" means!

Cultured meat has accelerated globally this year. However, competition is no more limited to tank capacity. Nutritional customization is now made possible for cultured meat. Customized lean-to-fat ratio? Yes! Customized flavors of fat? Yes! Customized content of saturated fat? Yes! This technology breakthrough has not only accelerated cultured meat but also every fat-related category!

Why do investors favor cellular meat worldwide? Some say cultivated meat is a more environmentally friendly option; some say cultivated meat is a bottom-up revolution in how human beings replenish meat; others say it is the choice of efficiency.

So, why don't we get all the investors together to discuss what we are pursuing for when investing in cultivated meat?

They are the top scientists and entrepreneurs in the cell culture meat industry, so take the opportunity to ask questions!

-Douyin e-commerce GMV grew over 80% compared to last year, and Douyin Mall GMV surged by 277% year on year.

-In the face of this "traffic is king" war, how do Three Squirrels implement the strategy of "product and sales integration" and "one product, one supply chain"? How to use sales to push back the supply chain optimization, and successfully create a number of single products with sales of tens of millions? And how did they work with thousands of live streamers to achieve a massive 500% growth in Douyin in just six months and become the No.1 in the snack category?

Frontline experience with customers all year round, powerful supply chain management, systematic innovation …retail private label giants and their suppliers have developed numerous popular new products. The evolution of private labels has shifted from price competitiveness to product strength and now towards building brand equity.

How can retailers continuously create products that appeal to consumers demanding both quality and affordability? What can different players do collectively to provide better products and services, fostering a positively competitive market environment?

Freshippo, Bravo, Hotmaxx, and Xiaohongshu have put forward and stressed the "buyer concept" and "product selection thinking" one after another in a recent couple of years. The underlying logic is to build attractive products and an integrated supply model emphasizing user value at retail and e-commerce rather than manufacturer value. In this connection, how does BaiXiang Food develop differentiated products based on consumer trend insights from different platforms? How does it combine with KOLs and buyers to strengthen the interaction between products and users and realize brand renewal?

In the past 100 days, the food and fresh produce sector of TAOBAO & TMALL GROUP has achieved a 70-fold increase in orders through the new channel-Tao gongchang. How does the platform help white-label factories unleash their production capacity to meet the segmented demands of the online market? Join us at FBIF to uncover the secrets behind creating million-unit bestsellers!

With 12 years of experience in the supply chain industry, Mr. Fan participated in the early establishment and operation of HotMaxx in 2020. Securing tens of millions in financing in 2021, he founded the discount retail store "Boom Boom Mart," which unfortunately exited in 2022. He then returned to the supply chain industry to focus on downstream and specialized channels and explore high-quality channels and origins. As someone who has witnessed channel transformations firsthand, how does he continuously help food companies discover more "sales partners," expand into new markets, and boost sales growth?

In 2023, Guo Quan Food was listed on the Hong Kong Stock Exchange and officially became a member of the ten-thousand-store club. As a community dining retail brand focusing on a central kitchen strategy, Guo Quan started with hotpot ingredients and continuously expanded its product range and SKUs, creating a growth flywheel through its channels and supply chain. Behind Guo Quan Food's ten-thousand-store success:

-How does the community dining model reshape family meals, encouraging more consumers to "eat well"?

-What growth opportunities does consumption stratification in lower-tier markets present for the food industry?

In 2023, "Mountains Moved Prices", discount stores, bulk-selling snacks stores, and price reductions became the main themes of physical retail in China. Faced with increasingly rational consumer behavior and a stronger pursuit of "excellent quality and reasonable price", should offline retailers universally opt for discount strategies? How can they navigate through this wave of discounts and find a way to survive?

With the instant retail market projected to reach 2,508.265 billion yuan by 2026, "instant" no longer simply implies “urgency” but is becoming a new, highly predictable lifestyle. As a pioneer in this field, Meituan Instashopping is gradually advancing "digital and retail integration" from a supply-demand perspective. Identifying more productive stores based on LBS demand to increase supply and optimize merchandise structure, thereby facilitating efficient distribution for brands. With the new trend of "In 30 minutes, everything at your doorstep", two key questions emerge:

-How do brands identify their target consumers?

-How can they efficiently appear where consumers need them?

According to Frost & Sullivan, the retail market size for vending machines in mainland China is projected to reach 73.9 billion yuan by 2027. This channel is closest to consumers and can be a "spotlight". In addition to sales, vending machines perform "frontline scouting and new arrival discovering" for CHI FOREST as strategic enablers. By prioritizing user needs and curating top products from various leading brands, vending machines create convenient retail outlets nearby, satisfying consumers' demand for instant purchases without waiting. This approach unlocks a larger market potential driven by the immediate consumption needs of users.

In 2023, China's cross-border e-commerce exports grew by 19.6% to 1.83 trillion yuan, with many sellers achieving breakthrough growth. The cross-border e-commerce industry is gradually shifting from extensive development to high-quality, refined growth. Amazon introduced a series of specific initiatives at the end of last year to empower China's "high-quality global expansion."

-How can food and beverage companies become skilled navigators in the vast ocean of cross-border e-commerce?

-How can brands leverage Amazon's powerful "sail" to navigate and succeed in international markets?

Southeast Asia, with its cultural affinity and market potential, has become the first destination for many Chinese food and beverage brands looking to expand internationally. But what has the actual market feedback been? Is the journey of brand expansion as smooth as expected?

Lazada, one of the largest online shopping platform in Southeast Asia, has witnessed the growth of Chinese brands in this fertile market. In this presentation, we will discuss the importance of a long-term strategy for food enterprises venturing abroad. We will explore how to thoughtfully plan and position, seize opportunities, and tackle challenges to ensure a steadier and more sustainable path in the international market.

As globalization progresses, the independent website and direct-to-consumer (DTC) models are becoming key strategies for building and expanding global brands. Shopify, the e-commerce platform with the second-largest GMV share in the US, will share how to build deep connections between brands and overseas consumers.

-How can independent websites achieve sustained growth in overseas markets through omnichannel integration, connecting online stores, retail entities, third-party platforms, B2B, and social media channels?

-How can brands maintain a global perspective while deepening refined operations in local markets, and how can data-driven decisions optimize user experience and increase brand loyalty?

It takes a global brand to compete against a global brand. Going overseas is an inevitable path, compounded by domestic market slowdown, overseas ecommerce acceleration, new opportunities brought along by ecommerce platforms like TikTok、Temu.

—What are the springboards businesses must not miss? How to deploy globally, mature market in Europe and North America, emerging markets in Southeast Asia, or niche markets in the Middle East, Latin America, and Africa?

—What skill set is required to approach overseas market? What are the challenges?

What are the unique genes of the Chinese food retail chain industry? How to better understand the needs of local consumers and realize business upgrading and product innovation to adapt to market changes? What are the lessons to be learned from the consumption champions born in Japan's ‘Lost Thirty Years’? GenBridge Capital will analyze Japan's retail industry innovation and the current changes in the Chinese food retail chain industry!

In Japan, a comprehensive discount store was founded in 1980, primarily selling closeout and overstock items. It has created a myth of consecutive double-digit revenue and profit growth for 34 years. With over 720 stores worldwide, the company has become the fourth-largest retail group in Japan. It is the King of Discount Retail in Japan—Don Quijote.

Don Quijote's revenue is projected to exceed 2 trillion yen (JPY) by 2025, equivalent to over 100 billion yuan (RMB). With its unique business model, Don Quijote has carved out its territory in the highly competitive Japanese retail market. Let's explore what insights its retail strategy can offer to Chinese businesses.

For Chinese brands, Japan represents a uniquely mature market compared to other overseas markets. As Japan's largest domestic e-commerce platform, Rakuten covers approximately 87% of the Japanese population, with its food business accounting for 38.3%. For Chinese sellers entering the Japanese market, how should they adapt to the changing local environment, innovate based on local consumer characteristics, and cultivate the market? Join us at FBIF to hear from the CEO of Rakuten Shenzhen Office as he decodes the differences between the Chinese and Japanese consumer markets and discusses how brands can implement a long-term approach to successful international expansion!

As one of the fastest growing regions in the world, Southeast Asia saw middle-class population reach 200 million in 2020, account for 1/3 of the total population. The region is often the first stop of Chinese businesses seeking overseas development thanks to its proximity in geography and consumption culture with China, fast growth of TikTok, Shopee, Lazada, and supportive e-commerce service, as well as the stable trade environment under RECP.

In just 8 years, Aice has become the leading traditional channel and second overall channel ice cream brand in Southeast Asia. It holds the top market share in Indonesia and its products are available in markets across Indonesia, Vietnam, the Philippines, Cambodia, Laos, and Timor-Leste. How did Aice engage in this mutual journey with Southeast Asian consumers?

Between 2023 and 2030, plant-based beverages are projected to reach a global market size of $71.62 billion, growing at a CAGR of 12.7%. As early as 1904, Chinese herbal tea appeared on the streets of America, introducing the world to this "Eastern mysterious beverage" over the past century. WALOVI, a well-known Chinese herbal tea brand, has been the global top-selling natural plant-based beverage for three consecutive years, successfully entering mainstream channels in North America from the Chinese market. Join us at the FBIF to hear this 200-year-old time-honored brand discuss how Chinese brands strengthen awareness among overseas consumers and gradually penetrate mainstream international markets and channels.

In an external environment characterized by slowing economic growth, intensified homogeneous competition, and an increasingly diverse and fragmented digital media landscape, how can brands strike a balance between long-term brand building and short-term growth demands? Furthermore, how can they seize opportunities for international brand development?

The internationally renowned brand strategy agency FutureBrand has served numerous global brands across various industries and has studios in over 20 countries. Sam, the Executive Creative Director for FutureBrand China, will provide forward-looking insights on global brand strategies through case studies of Atlantis Hotel, Jackery, Nespresso, and others.

Global brand design expert Simon Collins, former Creative Director for world-leading brands such as Nike, Polo Ralph Lauren, and Zegna, and former Dean of Fashion at Parsons School of Design, has helped transform the once-obscure design school into a global superbrand, collaborating with luxury conglomerates like Kering Group and LVMH. Currently based in Shanghai, he serves as the CCO of Design Innovation Institute Shanghai.

When discussing the topic of Chinese brands "going global," Collins, who has collaborated with numerous international and local fashion brands, remarked: Some local designers always hope that international consumers can perceive Chinese culture or elements through their designs; ironically, these local designers themselves rarely, if ever, wear those designs, yet they hope foreign consumers will choose them.

- Do Chinese brands need to incorporate "Chinese culture/elements" when going global?

- What insights can Chinese brands glean from internationally successful brands?

Collins will further elaborate on these questions and share his perspectives. We have extended the Q&A session to half an hour after the speech. Feel free to bring your questions for discussion!

Founding Prompt Design, the Thai design studio that has garnered over 200 international design awards within just 17 years, and making it the most decorated in Thailand. Renowned Thai designer Somchana Kangwarnjit, who has served over 300 clients including Nestlé, Tyson, Dole, and Meiji, will share invaluable insights on food and beverage brand expansion into the Southeast Asian market!

Topics to be covered include, but are not limited to:

- Should designs adapt to local customs or maintain their "original flavor"?

- What restrictions does the Thai market impose on packaging design?

- What regulatory considerations should be observed in packaging copywriting?

Join us for a wealth of knowledge on these and more topics!

Think Global, Act Local. Different cultural practices and packaging regulations around the world pose challenges for global packaging compliance. In December 2023, the Central Intellectual Property and International Trade Court of Thailand ruled against China's Luckin Coffee in a trademark infringement case against Thailand's Royal 50R Group. For many brands, failing to plan trademark strategies in advance and understand local intellectual property laws can lead to unexpected difficulties.

Furthermore, due to the unique nature of food products, different countries have more detailed regulations for labels and packaging across various categories, including requirements for font size and the placement of information on labels.

Packaging compliance is the foundation for the normal sale of products. How can we 'dance with shackles on,' adhering to compliance while using excellent packaging design to connect with local consumers?

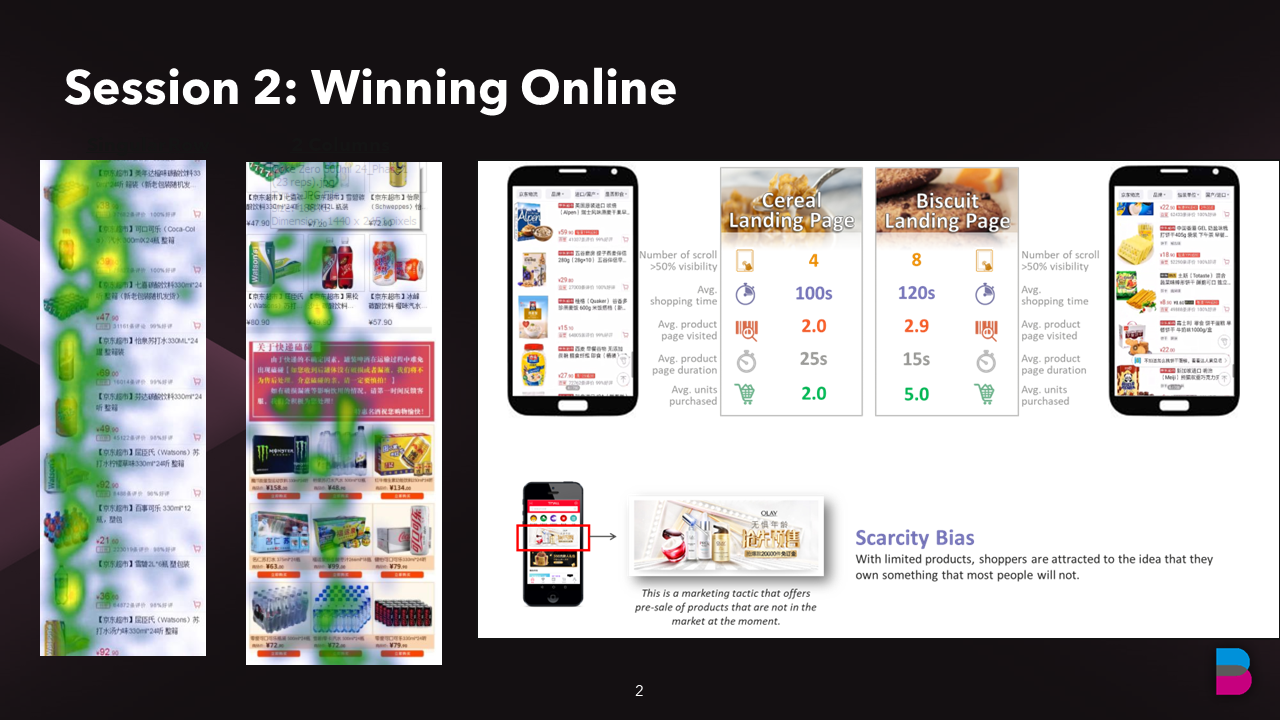

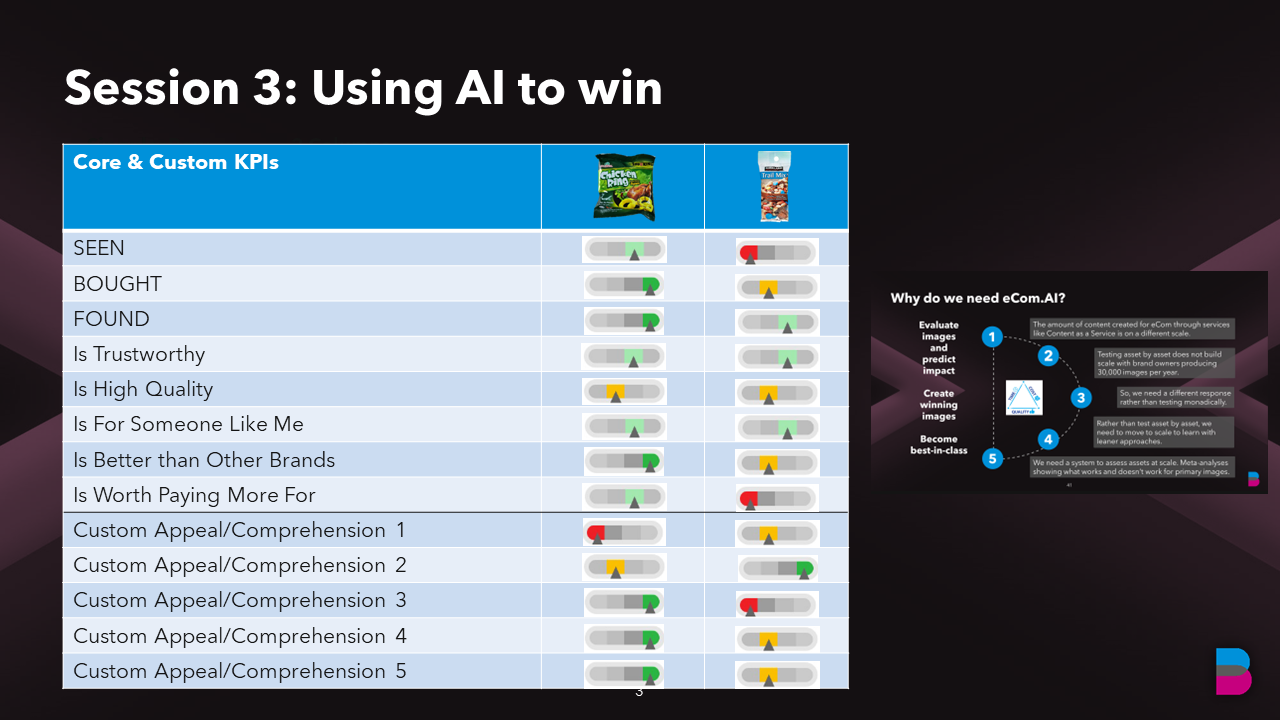

Behaviorally, one of the most renowned consumer behavior research institutions in the U.S., has amassed the world's largest consumer behavior database, exceeding 60 million behavioral data points over its 52 years of operation. They have customized over 160,000 simulated shelves for clients and facilitated the successful launch of more than 80,000 packages.

Behaviorally asserts that the moment of truth in marketing occurs when a purchase transaction takes place. The first touchpoint of consumer goods—packaging—significantly impacts shopper behavior. To improve sales conversion, they have condensed their professional practices into the 4S framework: Seen, Shoppable, Seductive, and Selected, to assess whether a package can "win on the shelf."

For consumer brands, today's shelf concept encompasses both offline retail shelves and online "shelves" on e-commerce platforms. These platforms present significantly different business challenges for brands. This workshop will guide you through both offline and online shelves, analyzing successful packaging design cases using the 4S framework. Additionally, participants will have the opportunity to experience eye-tracking technology firsthand and receive on-the-spot evaluations of their packaging designs using Behaviorally's latest AI tools.

How do you capture consumers' attention on real shelves? In the online e-commerce landscape, what are the differences in consumer behavior compared to offline shopping, and how can effective communication with consumers be achieved through screens?

From theory to practice, attendees will have the opportunity to experience real-world shelves and eye-tracking technology. They will use software to observe consumers' online shopping journeys and learn from experts on analyzing shopper behavior to develop packaging strategies that excel across all channels. In the online commerce segment, TMIC (Tmall Innovation Center) will also unveil their consumer insights and packaging analysis tools tailored for Alibaba's omni-channel platform.

In the diverse landscape of purchasing channels, characterized by shortened product innovation cycles and an accelerated pace, how do brands adapt their packaging development processes to accommodate these changes? In this session, we will invite brands to share their practical packaging strategies and insightful experiences, highlighting how they navigate and adjust to these evolving dynamics.

How can you determine if your packaging will succeed on the shelves? With Behaviorally, targeted AI model training can be conducted based on different product categories and market data by analyzing consumer behavior patterns. We invite you to bring your new product packaging to generate a Pack AI scorecard on-site!

Over her 16-year career in design, the red-haired dynamo, Chloe Templeman, has rapidly gained widespread influence within the industry through her dedication and sincerity. Her exceptional collaborations with high-profile clients such as Fortnum & Mason, Diageo, Unilever, Callaly, and Sacha Lichine have resulted in numerous internationally acclaimed design works. Chloe is also committed to giving back to the community, actively mentoring the next generation as a tutor for D&AD SHIFT and co-chairing the Pentawards.

In our current era of "collapsing" digital conventions, the pursuit of authenticity represents a fundamental human instinct. In her presentation, Chloe will discuss how brands can create authentic experiences that resonate deeply with contemporary audiences. Through a series of case studies, she will reveal strategies for forging impactful, genuine interactions in an increasingly homogenized digital landscape.

Typography is a critical element in visual communication. From sleek, modern sans-serif fonts to elegant, classical serif fonts, each typeface can evoke a unique emotional resonance in viewers. Nowadays, to invoke a sense of brand exclusivity in people's minds, more and more leading brands are opting to create custom fonts.

FounderType is the world's largest provider of Chinese typeface products, offering over 3,000 Chinese font styles. In recent years, FounderType has customized exclusive brand fonts for notable companies such as Coca-Cola, Alibaba, JD.com, HEYTEA, and Meituan. In this presentation, FounderType will share the stories behind these brand font customizations, discussing how brands cleverly use typeface design to establish deep emotional connections with consumers, and will present the latest trends and insights in font design.

Delicate chocolate squares are gently stacked on the soft, cloud-like snow, with the words "Melts in your mouth like snow..." and the golden "Meltykiss" logo, the packaging design of "Snow Kiss" chocolates exudes the dreamy, romantic aura of a teenage girl's story, just like the brand's promotional video.

In her nearly 30-year design career, designer Hiroko Ogawa, who has collaborated with brands such as Meiji, Tsujiri, and Suntory, has always insisted on crafting packaging that conveys emotions with softness and delicacy. She constantly ponders: How can audiences understand the "abstract" concept of experiential design?

"I believe that the result of products bringing people beautiful experiences is that even when the product is not visible, memories of the product and its deliciousness can still float in people's minds... Therefore, I'd like to invite everyone to play a little game about memories."

In Ogawa's carefully designed experiential workshop, participants are encouraged to bring their notebooks and pens. She will conduct a live comparison of snack packaging designs from China and Japan, highlighting specific areas where these designs could be enhanced.

Under the Suntory umbrella, BOSS Coffee features its iconic "Man Smoking a Pipe" logo. It was created by Suntory's Creative Director, Hiroyuki Ishiura. It is his profound insights into users that are behind his outstanding design. As a result of its continuous resonance with users' emotions, the BOSS coffee brand continues to evolve and grow, and now it boasts over 30 years of history. In 2022, BOSS's annual sales volume surpassed 100 million cases, making it one of the most renowned beverage brands in Japan.

In a short span of five years, Auge Design, an Italian design agency, achieved the remarkable feat of winning the prestigious Pentawards Diamond Award twice! When Auge was founded seven years ago, Creative Partner Davide Mosconi, primarily serving fashion and art brands, had never designed packaging before. Yet, he boldly accepted the challenging goal set by founder Giorgio Natale to become "Italy's premier packaging design agency."

"Why not?" he said.

Auge embarked on a journey of bold innovation, exploring the artistic sensibility of consumer product packaging design, and creating enduring brands of deliciousness. In 2023, Auge revitalized the brand and packaging of two global classics under the Bahlsen Group, "Pick Up" and "Leibniz," earning numerous international accolades.

What does "healthy" mean? Is it about a cleaner label? More eco-friendly? Or adding functional ingredients?

Danish design company EVERLAND has not only refreshed brands like Mizone, including its zero-sugar series, and become a design partner of Carlsberg since 2003, designing the packaging for 100+ products in its brand family, but also helped the emerging French plant-based meat brand La Vie achieve the top SKU sales within 18 months of launch. Chief Strategy Officer Christian will analyze the multiple pathways to becoming a "healthy" brand and their respective design strategies.

Fumi Sasada boasts nearly 50 years of design experience. At the age of 40, he served as the representative of Landor Associates in Japan; At 44, he founded Bravis (the name is a combination of Brand and Visual). At 54, he became the then President of the Japan Package Design Association; At 59, he published "CIKTMUPS: All About Package Design Goes on Sale". He has served various well-known brands, including Meiji, Kagome, Asahi, and Calbee. In this session, he will share insights into the packaging and market trends of health and functional food and beverages in Japan.

AB InBev links Corona with the dining scenario through limes. Oatly puts oat milk on a fast track by leveraging tea and coffee in China. Wusu and Hope Water builds up the momentum next to hotpots. Alienergy and Bu Shui La compete for sponsorship at ball sports and e-sports games. Clif Bar & Company, an American company for energy foods and drinks, connects with outdoor enthusiasts with the line "Keep Up with Season".

Specific scenarios contain endless opportunities for products and businesses. One may catch a big "fish" with solid work done in small "pools".

Starting from the essence of customer needs, this talk explores strategies for product development and structural optimization. It aims to break the deadlock and solve the enduring puzzles faced by businesses when expanding their product lines. The session will unveil the mystery of "whether to expand product categories and how to do so", discovering strategies that not only meet customer demands but also drive company growth.

If you live in a first- or second-tier city, you might not be familiar with Tianlala. Yet, it has silently "branched out" across county towns, townships, and schools, opening 7,000 stores in a decade. This number even surpasses McDonald's 6,657 stores (as of February 2024). How has Tianlala managed to expand so rapidly in lower-tier markets? What patterns have be identified in these markets, and what "battle-tested" experiences can be shared?

As the leading brand of authentic Liuzhou Luosifen, Haohuanluo has continuously driven the popularity of Luosifen through relentless product innovation and cross-industry marketing. This has secured its position as the "center stage" in the instant food sector, maintaining the global top sales of Luosifen for six consecutive years.

Yellow Swan pioneered the new category of "edible raw eggs" from scratch. By redefining the category and creating a systematic growth loop, they achieved a sixfold growth in two years, with annual revenue surpassing 1.8 billion yuan. Yellow Swan has successfully tackled the branding challenges in the 300 billion yuan egg market.

"One in every two young Chinese is a bilibili user." Now, bilibili's daily active users have surpassed 100 million, with young people unleashing strong consumer power, providing brands with significant growth. So, what signature strategies does bilibili have to help brands better connect with consumers?

Thai advertisements are a unique presence in the industry—what you can't imagine, Thai ads can achieve. While this may sound like a joke, you can always trust Thai ads! They'll make you "guess the beginning of the story but never the end." After watching, you'll find yourself savoring every moment, wanting more...

In one commercial, a Thai girl, desperate to make friends at her new school, tries various methods learned from her friend but fails until she discovers an app. Within three hours, the video hits a million views, and the app's downloads soar by 28% in just one day!

So where does the magic of Thai ads come from? And what lessons can we learn from them?

(Resource: WPP website)

Heinz, as a leading brand of western taste elevation, has not only successfully made its way onto Chinese dining tables but has also won the hearts of numerous consumers. So, what brand strategies has Heinz relied on to capture such a wide consumer base? Amidst opportunities and challenges, how does Heinz go about "pushing the limits" from product to context, and from insights to marketing, thereby attracting the attention of more potential consumers?

Currently, the only domestic energy drink brand with a revenue exceeding ten billion yuan - Eastroc Energy Drink, achieved a revenue of 10.3 billion yuan in 2023! In addition, the revenues of other growth brands like Eastroc Daka and Eastroc Bushuila reached 914 million yuan, marking a staggering year-on-year growth of 186.65%, demonstrating remarkable vitality!

Such remarkable performance not only reflects consumers' choices, but also embodies Eastroc 's successful brand strategy! So, what exactly has Eastroc done in terms of brand strategy to resonate so deeply with consumers?

In the 2019 "Fortune Global 500" rankings, the United States occupies 208 seats, while China has only 40 brands selected, none of which made it to the top ten. Brands should not be a weakness in China's international economic and cultural exchanges, and companies should not merely focus on short-term efficiency gains in the "fog" .

FBIF have invited Professor Jan-Benedict Steenkamp, the Massey distinguished professor of marketing and leadership at the University of North Carolina at Chapel Hill, as well as an author of the critically acclaimed book Brand Breakout: How Emerging Markets Brands Will Go Global (also published in Chinese) and one of the only three scholars to receive the highest lifetime achievement awards from both the American and European Marketing Associations. He is also a fellow at Fudan University, and Chairman International Board of Experts, Institute for Nation(al) Branding, Shanghai. He will personally guide you from brand construction to market expansion, showing you how to position your brand in China and embark on a global journey. Don't miss out on this two-hour workshop!

Today, consumers have diverse needs for similar products in different contexts. Building upon this, instant retail has further optimized the "thousand faces, thousand scenarios" marketing strategy in e-commerce, implementing refined operations to directly showcase products in various usage scenarios. As an industry leader, Meituan Instashopping has deeply collaborated with multiple top brands to jointly explore and implement this concept. Faced with the challenge of "thousand faces, thousand scenarios," what scientific and precise strategies should brands adopt to meet the diverse needs of consumers?